Appordable homes draw sharper competition

More buyers are clustering at the lower end of the market – and the data shows it’s no coincidence.

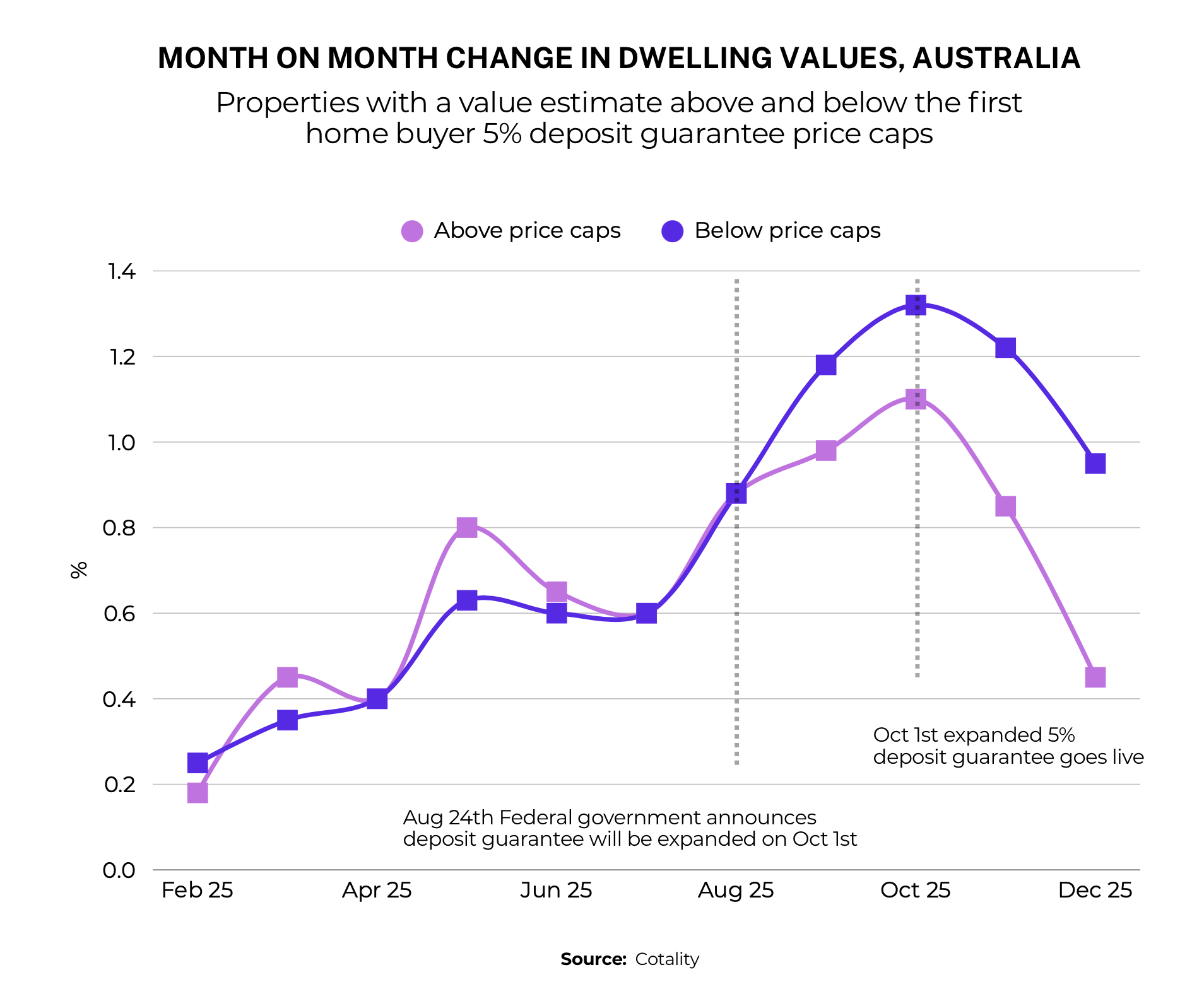

After the federal government expanded the 5% Deposit Scheme in October 2025, Cotality analysis shows homes priced under the scheme’s caps have generally outperformed higher-priced stock. In the December quarter, median prices rose 3.6% below the cap compared with 2.4% above it.

What’s interesting is timing. This trend appeared even before the scheme officially launched, suggesting some buyers moved early to secure properties before competition intensified.

Two forces are likely at play. Anticipation of extra demand brought buyers forward, while serviceability constraints continue to steer households towards homes that feel manageable week to week.

Before you chase a ‘below-cap’ property

Price caps vary by location and matter more than many buyers expect.

Not every lender assesses scheme loans the same way.

Your borrowing limit still hinges on standard credit checks and buffers.

If you’re considering a purchase in this price bracket, contact me and I’ll check eligibility, lender participation and what the repayments actually look like.