New car choices reshape finance decisions

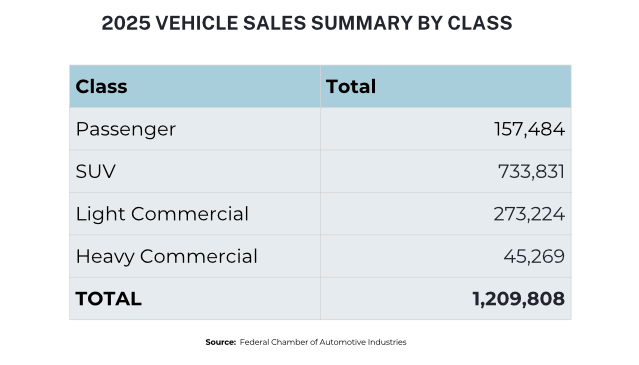

Australians are still buying new cars at high levels – but what they’re buying is changing.

New car sales in 2025 were just 0.9% lower than the year before, yet the mix shifted sharply. Plug-in hybrid sales surged 130.9%, hybrid sales rose 15.3% and battery electric vehicles accounted for 8.3% of all sales.

These shifts matter because different vehicles often come with different price points, running costs and finance structures. Longer loan terms, balloon payments and incentives can all change the real cost over time.

For households juggling a mortgage, car finance choices can quietly influence borrowing capacity and cash flow more than expected.

Before you lock anything in

Loan terms, rates and fees vary widely across lenders.

Balloon structures can lower monthly repayments but raise total cost.

Dealer finance isn’t always the most competitive option.

If you’re upgrading your car and want to make sure the finance fits alongside your home loan goals, contact me and I’ll help you compare options with the bigger picture in mind.