Line Of credit

A Line of Credit is a fully featured loan that can be a very effective, flexible tool to assist with debt reduction and the structuring of multiple loans. As the Line of Credit effectively acts as a savings account/home loan all in one, it can be confusing for some and requires discipline to manage it correctly – it is like having a large secured credit card against your house.

A Line of Credit is a fully featured loan that can be a very effective, flexible tool to assist with debt reduction and the structuring of multiple loans. As the Line of Credit effectively acts as a savings account/home loan all in one, it can be confusing for some and requires discipline to manage it correctly – it is like having a large secured credit card against your house.

Essentially a Line of Credit has a credit limit, all income is paid into the loan and funds can be withdrawn via a debit card as if it was a savings account. The only requirement is to meet the interest costs each month. The goal is to have as much money in the loan at all times, reducing the loan balance which the lender is calculating interest on, thus reducing the amount of interest charged at the end of the month. Pushing this concept one step further, you can use a credit card for all purchases using the bank’s interest free period on the credit card, whilst your money sits in the loan reducing the amount of interest you pay. The card is then cleared in full from the line of credit when it is due.

Budgeting is very important with a Line of Credit and when using a credit card for all purchases, as it may be easy to push the balance down but it is just as easy to draw those funds back out for a holiday, new tv etc, bringing the loan back up to the limit.

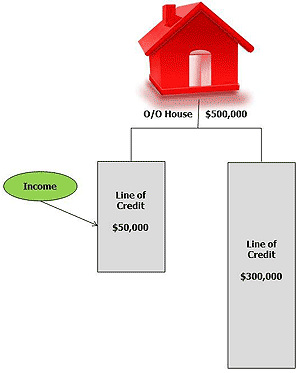

For investors, it can be an excellent tool to separate investment and personal debt. Ensuring there is clear division in the two is very important when it comes time to do your tax with your accountant.

These loans are an all in one loan and most are structured under a Package. The interest rate is variable so can move up and down with the market, but this does give you the flexibility to make unlimited additional repayments.

Before making a decision though, you need to discuss your options with a professional. Following an analysis of your situation, we will discuss the features of the many Loan Types available and match a solution that meets your requirements and objectives – see our Loan Process.